Top billionaires across the African continent in 2025 hold power built through ownership, expansion, and long-term control. Cement, telecom, diamonds, and banking remain the main paths to generational wealth. No sudden spikes. No tech hype. Only steady growth backed by assets.

Every name reflects presence across borders. Private firms, board seats, and multinational reach set each one apart. Fortunes rose through strategy, not chance. Each figure shaped markets and built dominance that continues through 2025.

12. Michiel Le Roux

| Detail | Info |

|---|---|

| Net Worth | $2.3 billion |

| Country | South Africa |

| Industry | Banking |

| Company | Capitec Bank |

Michiel Le Roux built Capitec into a banking force that flipped the system in South Africa. He targeted the working class, offered simple banking, and ignored elite models. Growth followed. Investors noticed. Capitec shares multiplied.

His wealth came slow, then surged. He no longer leads the daily grind but still holds influence. His equity speaks louder than his title. Capitec never leaned on gimmicks. Every profit margin came from mass appeal and scale.

Secret Behind Capitec’s Low-Cost Model

Capitec eliminated traditional branches in high-rent zones. The bank used smart algorithm-based credit scoring that reduced manual checks. That slashed overhead and let them dominate price-sensitive markets.

11. Issad Rebrab

| Detail | Info |

|---|---|

| Net Worth | $3.0 billion |

| Country | Algeria |

| Industry | Food, Industry |

| Company | Cevital |

Issad Rebrab took Algeria’s local food market and turned it into a continental force. Cevital holds dominance across several sectors: sugar, oil, steel, electronics. He scaled production with military focus. Imports dropped. Exports rose.

He stayed outside politics but built leverage none could ignore. His factories power jobs. His logistics networks stretch beyond borders. No gimmicks, no flashy headlines. Only output, volume, and numbers.

European Market Moves Through Cevital’s Acquisitions

Rebrab bought struggling factories in France and Italy through Cevital. He turned old industrial sites into profit centers, proving African capital could revive European production.

10. Patrice Motsepe

| Detail | Info |

|---|---|

| Net Worth | $3.1 billion |

| Country | South Africa |

| Industry | Mining |

| Company | African Rainbow Minerals |

Patrice Motsepe came up through mining, but not through inheritance. He focused on marginal shafts, bought cheap assets, and turned them around. His rise came through grit and legal precision. He understood mineral law better than most regulators.

His firm holds interests across gold, platinum, ferrous metals. Later, he branched into finance and sports, but mining still built his name. His influence reaches into diplomacy now. That started with ore, not words.

Deep Ties with African Political Elites

Motsepe holds strong family links with South Africa’s top political circles. His influence runs deeper than boardrooms. Policy access gave him a strategic edge across mining licenses.

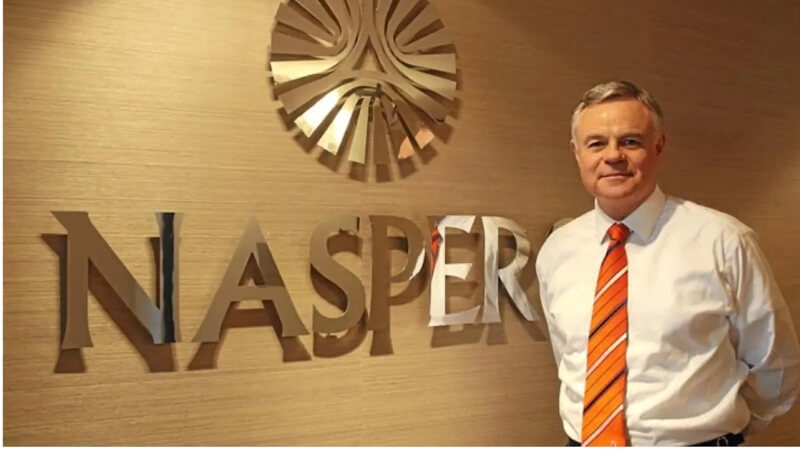

9. Koos Bekker

| Detail | Info |

|---|---|

| Net Worth | $3.3 billion |

| Country | South Africa |

| Industry | Media, Tech |

| Company | Naspers |

Koos Bekker turned media into equity. He took a stagnant South African publisher and threw it into the global tech race. Naspers locked in early Tencent shares before anyone saw the scale. That move built billions.

He never played safe. He skipped dividends and reinvested everything. He let tech firms run wild with capital. That chaos brought fortune. He does not chase interviews. He does not explain moves. Naspers moves speak for him.

Billion-Dollar Tencent Bet Explained

Bekker’s early investment in Tencent came after a cold email pitch from China. He trusted his gut, pushed $32 million, and turned it into billions. He never took a single salary as CEO.

8. Mohamed Mansour

| Detail | Info |

|---|---|

| Net Worth | $3.4 billion |

| Country | Egypt |

| Industry | Conglomerate |

| Company | Mansour Group |

Mohamed Mansour runs one of Egypt’s largest private empires. Automotive deals, construction, retail, tech—his holdings stretch wide. He brought GM to Egypt. He locked in distribution deals that print cash. His scale grew quietly.

Mansour Group never flashed hype. It controlled supply lines. It sealed contracts. It grew through logistics, not press coverage. His wealth stands firm because his structure holds across chaos and calm.

Exclusive Deal with Caterpillar

Mansour Group secured regional control of Caterpillar distribution in multiple African countries. That deal built a revenue stream tied to infrastructure expansion across borders.

7. Abdulsamad Rabiu

| Detail | Info |

|---|---|

| Net Worth | $4.9 billion |

| Country | Nigeria |

| Industry | Cement, Sugar |

| Company | BUA Group |

Abdulsamad Rabiu built BUA into a sharp competitor to Dangote. Cement wars shaped Nigeria’s economy for years. He held his ground. He undercut prices. He built faster. He did not wait for handouts or favors.

His plants power key regions. His sugar refineries feed millions. He built scale on Nigerian soil. No offshore escape. No foreign shuffle. His name grew because his factories never stopped. He bets on infrastructure. He delivers on ground.

Cement Expansion into Francophone Africa

BUA Group pushed into Niger and Benin Republic with new cement plants. Rabiu used lower export tariffs and fast-track logistics to break French-dominated markets.

6. Naguib Sawiris

| Detail | Info |

|---|---|

| Net Worth | $5.0 billion |

| Country | Egypt |

| Industry | Telecom |

| Company | Orascom |

Naguib Sawiris played telecom like chess. He entered markets others feared. He built Orascom into a global telecom force, moved into risky zones, then flipped those bets for massive exits. He sold to VimpelCom and walked out with billions.

He shifted later into finance, media, and politics. But the foundation stayed with signal towers and telecom grids. His cash came through bandwidth and risk. No slow grind. No safe game.

Launched First Private Mobile Operator in North Korea

Sawiris entered North Korea in 2008, launching Koryolink. He remains one of the few foreign businessmen to cut telecom deals inside a closed state.

5. Mike Adenuga

| Detail | Info |

|---|---|

| Net Worth | $6.8 billion |

| Country | Nigeria |

| Industry | Telecom, Oil |

| Company | Globacom, Conoil |

Mike Adenuga built Globacom as a telecom giant that challenged Airtel and MTN on home turf. He priced low. He expanded fast. He planted his brand deep. His customers built his margin.

Oil also lined his accounts. Conoil gave him upstream access others could not match. He never stayed loud in media, but his balance sheet always roared. Power deals, spectrum rights, and oil blocks kept the money flowing without noise.

Closed-Door Fight Over International Subsea Cables

Adenuga clashed with MTN over rights to West Africa’s submarine cable network. He backed alternative infrastructure through Glo-1, bypassing dependency on competitors.

4. Nassef Sawiris

| Detail | Info |

|---|---|

| Net Worth | $9.4 billion |

| Country | Egypt |

| Industry | Construction, Investment |

| Company | OCI, Adidas (Stake) |

Nassef Sawiris took construction wealth and flipped it into global assets. He led OCI through fertilizer dominance, then moved into European equities. He holds a stake in Adidas and carries weight on its board.

He operates in silence. No drama. No press games. His power lies in numbers, not headlines. His bets rarely miss. He invests with a scalpel, not a shotgun. Egypt, Europe, sports, chemicals—he sits across boardrooms with one goal only: equity power.

Silent Real Estate Holdings in New York and London

Through layered firms, Sawiris acquired luxury properties in Manhattan and Central London. He never attached his name publicly but holds massive urban real estate quietly.

3. Nicky Oppenheimer

| Detail | Info |

|---|---|

| Net Worth | $10.4 billion |

| Country | South Africa |

| Industry | Diamonds |

| Company | De Beers (Former), Private Equity |

Nicky Oppenheimer sold his stake in De Beers, but the name still echoes in every diamond boardroom. He shifted his wealth into private equity after leaving the mining frontlines. The mines built him. The deals now keep him.

His family ran diamonds for generations. He cashed out, but his cash stayed working. He funds conservation, education, investment. He no longer holds a pickaxe. He now controls capital silently.

Reinvestment into African Aviation

Oppenheimer placed major funds into African aviation through Fireblade Aviation. He built private terminals that cater to ultra-high-net-worth clients and diplomatic missions.

2. Johann Rupert

| Detail | Info |

|---|---|

| Net Worth | $13.7 billion |

| Country | South Africa |

| Industry | Luxury Goods |

| Company | Richemont |

Johann Rupert owns time. Literally. His brands—Cartier, Montblanc, IWC—run the luxury game worldwide. Richemont owns wrists, pens, and power moves. His empire stands behind wealth, not fame.

He stays out of public debate. He lets watches and margins speak. His boardrooms stretch into Europe’s elite. Every expansion shows careful patience. His brand lineup never chases hype. He keeps his position with taste, not noise.

Personal Collection Worth Over $500 Million

Rupert owns one of the largest private art and antique collections in Africa. His collection includes rare Patek Philippe watches, colonial-era firearms, and Dutch oil paintings.

1. Aliko Dangote

| Detail | Info |

|---|---|

| Net Worth | $23.8 billion |

| Country | Nigeria |

| Industry | Cement, Sugar, Refining |

| Company | Dangote Group |

Aliko Dangote stands alone at the top. Cement built his throne. Sugar added weight. Now the refinery seals it all. His new Lagos refinery cuts deep into Nigeria’s fuel imports. His control now touches energy.

He owns his factories. He owns his fleet. He owns the routes. No middleman takes his margin. His name runs on trucks, bags, and shares. He towers above rivals not through words but through full supply chain dominance. No gaps. No soft points.

Exclusive Rights to Nigerian Oil Output

Through strategic lobbying, Dangote Group secured first-refusal rights on domestic crude supply for refining. That locked out foreign refiners and cemented control of Nigeria’s energy chain.

Last Words

Every number in this list came from grit, not luck. Each name held the line when markets shook. They moved in silence, stacked equity, and outplayed louder rivals. No one gave them space—they took it.

Their stories cut across borders, industries, and decades. Some climbed back after collapse. Some never fell once. Every one of them owns more than money. They hold reach, leverage, and time.