Federal solar tax credits offer businesses a valuable opportunity to offset the costs of transitioning to renewable energy.

These incentives not only make solar energy systems more affordable but also encourage sustainable practices.

Understanding the eligibility criteria is crucial for businesses to maximize these benefits while ensuring compliance with applicable laws and regulations.

Types of Federal Solar Tax Credits for Businesses

Federal solar tax credits are designed to incentivize businesses to adopt renewable energy technologies by reducing their financial burden.

Among the various incentives, two prominent programs stand out: the Investment Tax Credit (ITC) and the Production Tax Credit (PTC).

These programs cater to different aspects of solar energy investment, ensuring businesses of all sizes can benefit from transitioning to cleaner energy sources.

Investment Tax Credit (ITC)

The Investment Tax Credit (ITC) is one of the most significant federal incentives for businesses adopting solar energy systems.

It provides a dollar-for-dollar reduction in federal income taxes based on a percentage of the installation costs of solar systems.

The incentive plays a role in reducing the upfront cost of adopting solar technology, making it a preferred choice for many businesses.

Key features of the ITC include:

- Current Rate: Offers a 30% tax credit for projects that begin construction by 2032.

- Step-Down Timeline: The credit decreases to 26% in 2033 and 22% in 2034, with further adjustments subject to legislative actions.

- Eligible Technologies: Covers not just photovoltaic systems but also solar water heaters, solar-powered cooling systems, and geothermal systems.

- Flexibility: Businesses can carry forward unused credits to future tax years if their tax liability is insufficient to absorb the full credit.

Production Tax Credit (PTC)

The Production Tax Credit (PTC) rewards businesses based on the electricity generated by their solar energy systems, providing a long-term benefit for operational efficiency.

Unlike the ITC, which reduces upfront installation costs, the PTC incentivizes sustained energy production over time.

Key features of the PTC include:

- Provides a per-kilowatt-hour (kWh) credit for electricity generated over the first 10 years of the system operation.

- Focuses on larger-scale projects, with specific size and energy output thresholds required for participation.

- Particularly beneficial for utility-scale solar installations and businesses with high energy demands.

- Although primarily associated with wind energy, the PTC is an essential option for specific solar projects, particularly those designed for high-output generation.

If you are uncertain how to handle solar tax credits for businesses, you can pay a visit to www.accountancycapital.co.uk.

General Eligibility Requirements

Businesses must meet specific criteria regarding their entity type, the properties where solar systems are installed, and the technical standards of the systems themselves.

Eligible Entities

Federal solar tax credits are available to a broad range of businesses and organizations.

However, the ability to claim these credits depends on the entity’s tax status and compliance with federal regulations.

Key eligible entities include:

- Both large and small businesses structured as corporations can claim credits.

- Partnerships can pass credits to individual partners in accordance with their share of ownership.

- Independent business owners can claim credits if they meet federal tax liability requirements.

- While tax-exempt entities typically do not qualify, creative financing mechanisms such as Power Purchase Agreements (PPAs) or leases can provide indirect benefits.

- Schools, municipalities, and other public institutions may benefit indirectly through solar leasing arrangements.

Eligible Properties

To qualify for federal solar tax credits, the properties where solar systems are installed must meet specific criteria.

Eligible properties must demonstrate that the solar system contributes to their operational energy needs.

Key eligibility criteria for properties include:

- Commercial buildings, industrial facilities, and leased spaces are all eligible for solar installations.

- The system must serve a practical purpose such as generating electricity, heating, or providing hot water for the property.

- Properties must be owned by or leased to the business claiming the credit, ensuring the entity benefits directly from the installation.

System Requirements

Solar energy systems must adhere to stringent technical and regulatory standards to qualify for federal tax credits.

These requirements are in place to maintain high system quality and operational efficiency.

Key system requirements include:

- All equipment used in the solar installation must be certified to meet federal quality and efficiency standards.

- The system must be installed according to manufacturer guidelines and by certified professionals.

- Systems must comply with local and federal safety regulations, ensuring they operate effectively and sustainably.

Specific Eligibility Criteria

Federal solar tax credits come with specific eligibility criteria to ensure the incentives are awarded to projects that align with national renewable energy objectives.

Location requirements mandate that solar installations must be situated within the United States or its territories. It ensures that the systems contribute directly to domestic energy goals by promoting renewable energy production within the nation.

Businesses are required to provide documentation proving that the installation site complies with these geographic criteria.

The new equipment mandate emphasizes the importance of utilizing only new and unused equipment for solar installations.

Federal tax credits cannot be claimed for refurbished or second-hand components, as the program is designed to encourage investments in cutting-edge renewable energy technologies.

For projects involving tax-exempt entities, such as schools or non-profits, restrictions apply to prevent direct claims on federal solar tax credits. Since these entities do not have federal tax liabilities, they cannot benefit from the credits directly.

However, businesses can still engage in solar projects with tax-exempt organizations through innovative financing methods like power purchase agreements (PPAs).

Bonus Credit Opportunities

Federal solar tax credits include additional bonuses that businesses can leverage to increase their financial incentives.

These bonus credits are designed to target specific priorities, such as boosting domestic manufacturing, supporting economically disadvantaged areas, and addressing energy accessibility for low-income communities.

Domestic Content Bonus

The domestic content bonus incentivizes businesses to prioritize solar components manufactured in the United States.

The bonus supports the growth of local industries, creates jobs, and promotes energy independence.

Key aspects of the domestic content bonus include:

- Businesses must ensure that a designated percentage of the solar system components, such as solar panels, inverters, and mounting structures, are manufactured in the U.S.

- Encourages reliance on American-made components, reducing dependency on international supply chains.

- Provides additional tax credits that supplement the standard ITC or PTC rates, making solar projects more financially attractive.

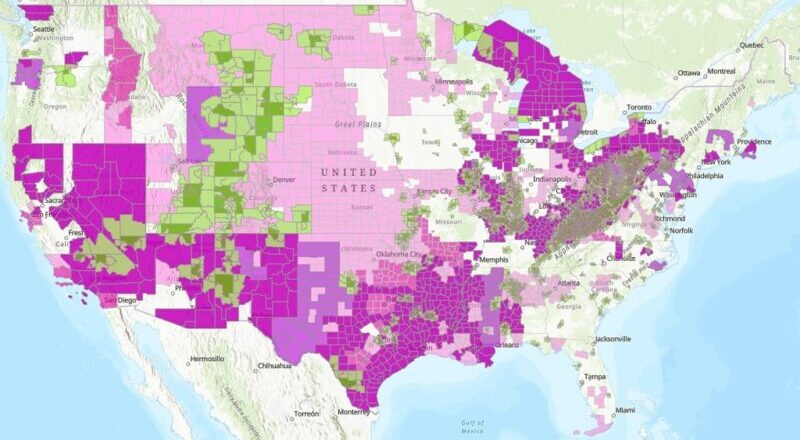

Energy Community Bonus

The energy community bonus is aimed at revitalizing regions that have been economically impacted by the decline of traditional fossil fuel industries.

These areas, often referred to as “energy communities,” are prioritized for renewable energy development.

Key highlights of the energy community bonus include:

- Projects must be located in areas with high unemployment or a history of economic reliance on fossil fuel extraction or processing.

- Stimulates economic growth in disadvantaged regions while transitioning to renewable energy sources.

- Qualifying projects receive increased tax credit percentages, enhancing their overall financial viability.

Low-Income Community Bonus

The low-income community bonus targets energy equity by providing additional credits for solar projects that directly benefit underserved populations.

The bonus plays a crucial role in reducing energy costs and increasing access to renewable energy.

Key features of the low-income community bonus include:

- Projects must be located in designated low-income areas or serve households with limited access to affordable energy.

- Addresses energy affordability challenges while promoting the adoption of sustainable energy solutions.

- Helps businesses align with social responsibility goals by contributing to community well-being and environmental sustainability.

Recent Legislative Updates

Federal solar tax credits have undergone significant changes in recent years, driven by new legislation aimed at promoting renewable energy adoption and sustainability.

The Inflation Reduction Act of 2022 introduced sweeping reforms that expanded the scope and impact of solar incentives, ensuring they remain a viable option for businesses.

Inflation Reduction Act of 2022

The Inflation Reduction Act of 2022 marked a pivotal moment for federal solar tax credits, introducing substantial enhancements that provide long-term stability and increased benefits for businesses.

Key provisions of the Act include:

- Extended the 30% ITC for projects beginning construction by 2032, with a gradual step-down to 26% in 2033 and 22% in 2034.

- Broadened the range of technologies and projects that qualify, including hybrid solar systems and emerging renewable energy technologies.

- Introduced new opportunities for businesses to earn additional credits through the Domestic

The Bottom Line

Federal solar tax credits present significant opportunities for businesses to reduce energy costs and contribute to sustainability.

By understanding eligibility criteria and leveraging available incentives, businesses can make informed decisions.

Consulting tax professionals ensure accurate claims and maximized benefits.